Introduction

Oklo stock price The clean energy revolution is in full swing, and nuclear technology is reemerging as a key player in the global shift toward sustainability. Amid this transformation, Oklo Inc. has positioned itself as a bold innovator, gaining attention not only for its microreactor technology but also for its growing presence in the stock market. With climate concerns mounting and investors increasingly drawn to green tech, the Oklo stock price has become a focal point for those eyeing the future of clean, compact nuclear power.

Oklo isn’t just another energy company. Its goal of decentralizing nuclear energy and deploying advanced fission reactors has captured both government and investor interest. As it navigates through early growth phases, the company’s stock performance has attracted significant scrutiny and speculation. Investors, analysts, and clean tech enthusiasts are closely watching its journey oklo stock price.

This article dives deep into everything you need to know about the Oklo stock price—from its origins and market performance to the various forces influencing its valuation and where it may be headed next. Whether you’re a long-term investor or just starting your research, this guide offers a comprehensive look at one of the most talked-about green energy stocks in the market.

What Is Oklo Inc.? Company Overview and Market Position

Founded in 2013, Oklo Inc. is a California-based nuclear energy company on a mission to transform the way the world generates power. Unlike traditional nuclear plants that require large infrastructure and substantial regulatory oversight, Oklo focuses on developing compact, self-sustaining microreactors designed for safe, efficient, and long-term energy production. Its flagship product, the Aurora Powerhouse, is a small modular reactor (SMR) that aims to provide reliable clean energy in remote areas, data centers, and even off-grid communities oklo stock price.

What truly differentiates Oklo from other nuclear ventures is its agile startup model combined with groundbreaking technology. By leveraging advanced fuels and eliminating the need for water cooling systems, Oklo’s reactors are not only more sustainable but also less prone to the risks typically associated with conventional nuclear plants. This innovation has positioned Oklo at the intersection of tech and energy—two sectors attracting immense investor attention.

The company gained additional visibility when it entered the public markets via a merger with a special purpose acquisition company (SPAC), AltC Acquisition Corp., co-founded by OpenAI CEO Sam Altman. The move was seen as a strong vote of confidence in Oklo’s vision and has sparked heightened interest in its stock. With high-profile backing, a clear regulatory roadmap, and a unique market niche, Oklo is carving out a promising position in the global energy transition landscape oklo stock price.

Oklo Stock Price History and Performance Analysis

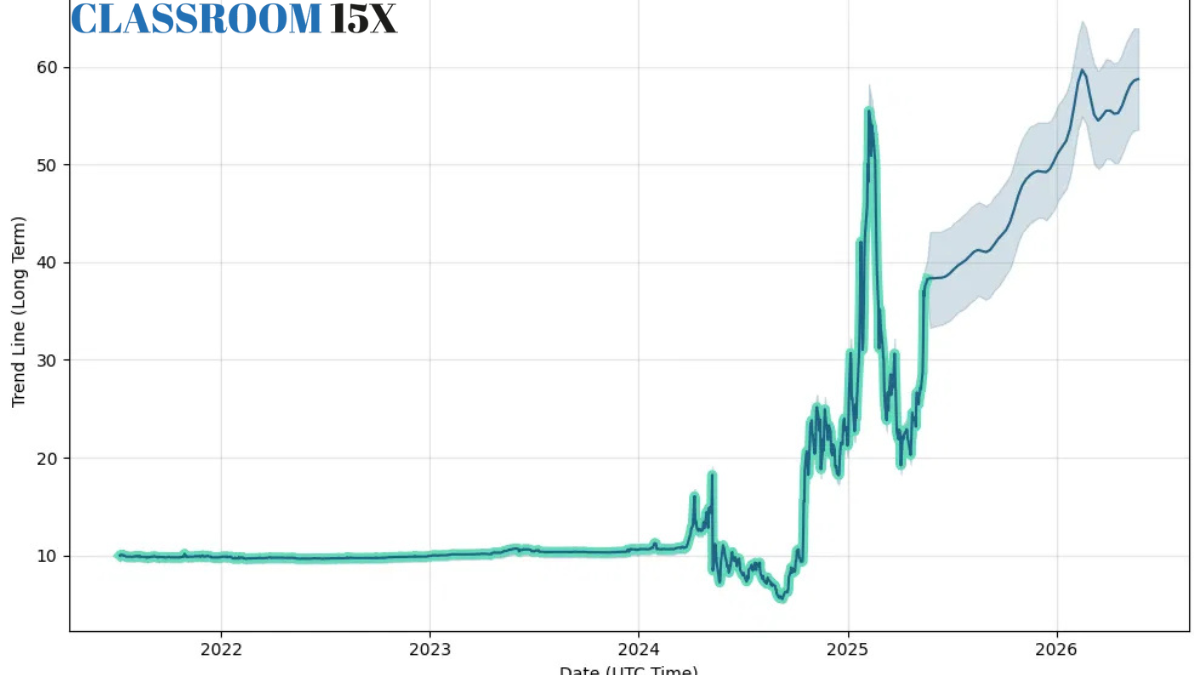

Since Oklo’s public debut through its SPAC merger, its stock price has seen notable fluctuations—a hallmark of any early-stage company in a disruptive sector. The Oklo stock price initially surged due to media hype, investor enthusiasm, and a wave of interest in alternative energy sources. However, as with many newly listed firms, volatility soon followed, reflecting market uncertainties and the high-risk nature of tech-driven energy ventures oklo stock price.

Analyzing the historical performance of Oklo’s stock, it’s evident that macroeconomic conditions and investor sentiment have had significant effects. For instance, broader market corrections and fluctuations in energy policy often lead to dips, while positive news—such as government grants or new partnerships—has triggered rallies. This cyclical behavior mirrors trends seen in other speculative clean energy stocks.

For long-term investors, it’s crucial to look beyond short-term price swings and evaluate Oklo’s potential in terms of technological scalability, revenue models, and strategic execution. Unlike companies with steady cash flows and established demand, Oklo is still proving its business case to the market. As such, the stock’s past performance is less about profits and more about promise. Those who believe in Oklo’s mission often view the stock as a long-term bet on the evolution of nuclear technology, rather than a quick-return play.

Key Factors Influencing Oklo Stock Price

Several interrelated factors influence the Oklo stock price, making it essential for investors to adopt a holistic view. At the forefront is the regulatory environment. Nuclear technology is one of the most heavily regulated industries worldwide, and delays in approvals or shifting safety standards can significantly affect market confidence. However, Oklo has already demonstrated progress by becoming the first company to have a combined license application accepted for review by the U.S. Nuclear Regulatory Commission (NRC) in over 30 years—a significant milestone.

Another critical factor is technological innovation. Oklo’s success hinges on its ability to efficiently manufacture and deploy its Aurora reactors. Any technical setbacks or missed timelines could have negative repercussions on investor sentiment. On the flip side, major breakthroughs or successful pilot deployments could propel the stock price to new highs by confirming the company’s value proposition.

Macroeconomic conditions and clean energy policy also play substantial roles. As governments ramp up their net-zero targets, demand for carbon-free power solutions is expected to surge. Oklo, positioned at the nexus of nuclear innovation and green infrastructure, stands to benefit. However, broader market downturns, inflationary pressures, or reduced clean tech funding could suppress growth temporarily oklo stock price.

Lastly, public perception and media narratives can create dramatic short-term shifts. Positive coverage can drive speculative interest, while controversies—even if unfounded—can harm the stock’s momentum. In this regard, Oklo’s leadership, partnerships, and transparency will be vital in shaping long-term investor trust.

Oklo Stock Price Forecast: Short-Term and Long-Term Predictions

Predicting the Oklo stock price involves a blend of technical analysis, market trends, and speculative forecasting. In the short term, price movements are likely to remain volatile, especially as the company continues to build prototypes, secure regulatory approvals, and form key partnerships. Analysts following the company often adopt a cautious tone, setting price targets that reflect both high growth potential and inherent risk.

Technical indicators such as moving averages, relative strength index (RSI), and volume patterns offer some insight into entry and exit points, but they must be interpreted carefully, given Oklo’s relatively short trading history. Fundamental analysis remains challenging due to the company’s pre-revenue status, making valuation models highly speculative. However, projected contracts and potential government incentives offer bullish signals for those with a long-term outlook.

Looking ahead, Oklo’s long-term forecast is tied closely to the global energy transition. If the demand for small modular reactors grows—and Oklo continues to hit operational milestones—its stock could see exponential growth over the next decade. Countries seeking decentralized, clean energy solutions may serve as future clients, unlocking recurring revenue and expanding market share.

Still, investors should approach with a balanced perspective. While the potential upside is significant, the risks are equally real. Long-term success will depend on technology deployment, market adoption, and continued innovation in a highly regulated field.

Conclusion

Oklo Inc. represents a fascinating blend of innovation, ambition, and disruption in the clean energy space. While the Oklo stock price may currently reflect the volatility of an emerging technology company, its broader narrative suggests a compelling long-term opportunity. With advanced microreactor technology, regulatory milestones achieved, and support from high-profile investors, Oklo has laid the foundation for future success.

For investors seeking exposure to next-generation nuclear energy, Oklo’s stock is more than a ticker symbol—it’s a glimpse into the potential future of global power generation. However, it’s crucial to approach this investment with diligence, patience, and a clear understanding of the associated risks.

Also Read: simone biles husband height